How CFO’s Evaluate Deals: 3 Things You Need to Design Finance’s Dream Deal

Most likely, you’re painfully aware that when inflation is up, capital becomes more expensive — which shrinks budgets like cotton sweaters in the dyer.

This also means spending limits fell like rain drops in H2 last year, so:

- Finance is now involved in more buying decisions.

- They hold greater influence in the decision process.

Which leaves you with two options this year:

- Cut the scope of your projects to stay off the approval radar.

- Design your deals with finance in mind.

If you’re looking to continue landing large deals, it’s not much of a choice. You need to structure and de-risk your deals to appeal to the CFO.

Here's how.

Finance is Strategy, NOT Accounting

Given the reality above (which is kind of old news now), I’ve been reading a lot of well-meaning posts with advice on selling to CFO’s. There’s a big problem with a lot of them, though.

They still see Finance as accountants and bean counters out to spend as little as possible.

And it's so 2010. Here's the right way to think about the CFO. Finance = Strategy.

Take it from a CFO of a Series D company who I sold to in the past. She recently raised a $150M round, and here’s how she described her job:

Yes, I’m a CPA, but I don’t spend my time as an accountant. My job is company strategy.

If our company’s an airplane, then I’m the pilot, and my head of FP&A is my co-pilot, even though most people think of our CEO as the pilot. He says where we’re going, sure, but we plan the route to fly the plane there safely.

We tell sales and marketing, our engines, how much fuel they can burn. We drive R&D spend for new product development to spread our wings, to carry more passengers. And we help operations engage the passengers, so they spend more during the flight.

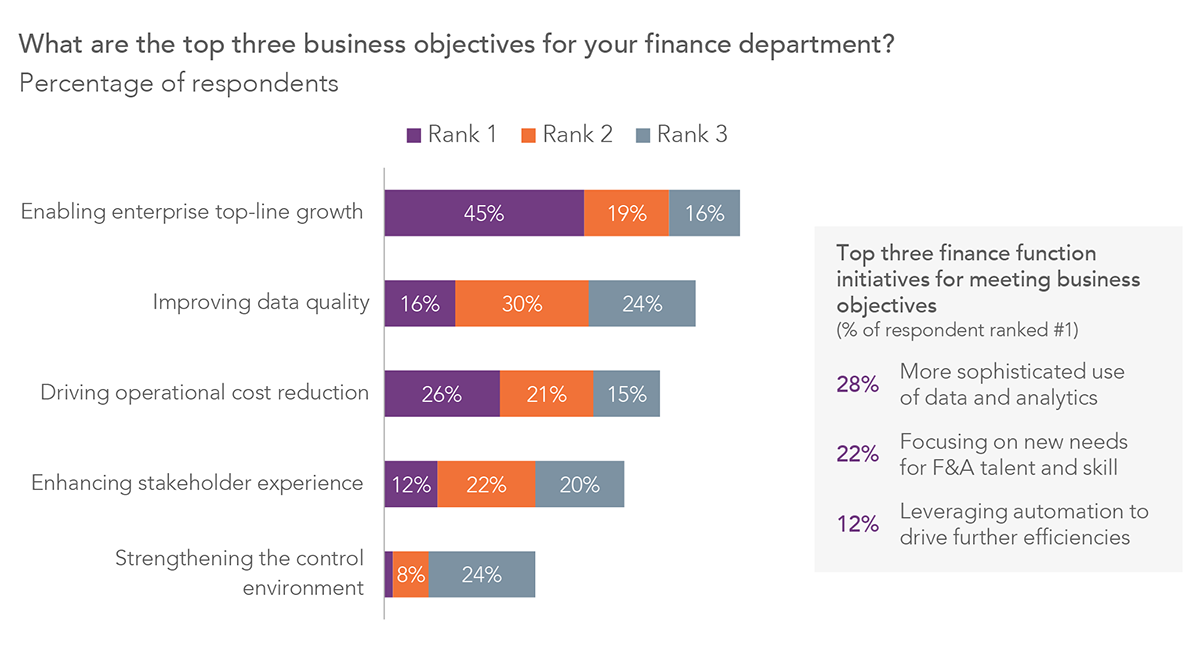

Here’s another example — data from a 2022 HFS Research study with 250, Global 2000 finance executives, asking about their top three objectives:

Did you catch that? Enabling top-line growth is priority #1.

If you read this chart without the headline, you’d assume they surveyed CRO’s. Not CFO’s.

A CFO’s Mental Model for Evaluating Buying Decisions

The pilot analogy perfectly captures the CFO’s mindset and their #1 goal. They’re driving the company strategy, but they’re doing it like a pilot — someone who operates in a highly-structured way because safety (i.e. removing risk) is key.

In short, a pilot’s job is to:

- Get to a target destination on time (or early),

- While burning the least amount of fuel,

- And guaranteeing passenger safety.

Likewise, the CFO’s job is to:

- Hit company revenue targets asap,

- While spending the least amount of capital,

- And undertaking the smallest amount of risk.

And just to make sure we’re breaking the “accounting” stereotype in this mindset shift, here’s one more analogy. Think of Finance like a “mini VC firm” because they both:

- Analyze a company’s past performance and future potential,

- To selectively deploy capital across a portfolio of “bets,”

- That generate outsized returns for shareholders.

Both analogies highlight three elements to the CFO’s job, which are the same three drivers behind every decision they make:

- Revenue

- Expenses

- Risk

Pretty simple, right? Well now, we can combine those elements into a mental model that captures how most CFO’s approach evaluating new projects. Including your deals.

So Project Value = [Financial Value (x) Risk] + [Strategic Value (x) Risk], where:

- Financial Value = Revenue (-) Expenses.

- Strategic Value = Better positioning to capture Financial Value in the future.

- Risk = The probability a project succeeds (or fails). Viewed as a range, or set of scenarios.

In the order from most —> least appealing, this model says your deal creates value in a CFO's mind when you enable:

- More (strategic) revenue for less cost and risk.

- The same (strategic) revenue for less cost and risk.

- More (strategic) revenue for the same cost and risk.

With the groundwork laid, now we can go deeper on this and the model’s three drivers.

(You’ll want to read to the end. Risk is the most nuanced and detailed of these sections.)

1/ Growth Priorities Determine Your Strategic Value

Value is only found in the context of a company priority.

Your ROI (high Financial Value) might look like a no-brainer, but if it’s not attached to an executive priority (low Strategic Value), your deal won’t even show up on the CFO’s radar.

For example, let's say you’re focused on driving a $10M revenue increase for an existing product, and think your numbers look pretty good. Meanwhile, the CFO’s focused on a new product launch that’s expected to drive $1M this year... but $100M in the following two years.

This is the second half of the Project Value equation.

Now, let's assume you are in fact aligned with an executive priority, like the new product launch. If your project requires a significant upfront investment, it can reduce your Strategic Value.

Even if you can show a lower “total cost of ownership” over the project’s lifetime. Because you’re tying up capital, which limits the CFO’s ability to invest in other projects.

Plus, you’ve effectively created more "internal competition" for your deal from other strategic projects, which the CFO can't invest in if you're tying up more capital.

That's important, because your company always prefers cash paid upfront. Your comp plan may even incentivize you to structure deals accordingly — which is at odds with the CFO’s mindset.

2/ If You’re Not a Category of One, You’re Doomed to Compete on Cost

A related point: cutting costs creates optionality, which is its own type of Strategic Value. When a CFO’s lowers costs, they're freeing up cash for other, future investment decisions. So there is some truth to the "bean counter" persona, but it's because there's a strategic link in play.

This is why there’s zero debate about spending less to accomplish the same objective.

And it's exactly why you’re doomed to compete on price if you’re seen as a commodity.

For example, let’s say you have $30 cash. Your partner asks you to pick up four grocery items on your way home. They’re making Italian food for dinner.

It wouldn't be smart to buy a $25 bottle of wine. You’d be taking a big risk. If you couldn’t afford to buy noodles, garlic and tomatoes with your last $5, the dinner fails.

So you’d “shop around” for a different wine that will still flavor the dish, but conserve cash. That would be easy, too. A $25 bottle of wine tastes the exact same as a $10 bottle in tomato sauce. In this context, wine is a commodity. One bottle works just as well as the next.

The way around this? Positioning your company in a different category.

Appeal to your partner’s love of truffles with a ready-made, organic, white truffle sauce. Even if it’s a $20+ sauce, there’s no need for wine, tomatoes and garlic. This is why, for every $1.00 in revenue growth, category creators generate $4.82 of market cap growth.

(Practically speaking, this is done inside your narrative — and deal positioning inside a category of your own is one lesson in the Crash Course.)

3/ Risk Appetite Can Kill Deals, Fast

Speak of Italian food… different CFO’s have different appetites for risk.

A global enterprise vs. a Series B startup obviously hold different risk appetites. And a Series B startup with 36 months vs. 6 months of runway will also have different risk appetites.

So here’s the way to think about the (crippling) power of risk in your deals.

Take three examples:

- A big bet on a new, “AI-powered” something with a significant but risky ROI.

- A middle-of-the-road approach. It has more proven success, and a moderate return.

- The safe route, sacrificing some of what the other projects promise, for less risk.

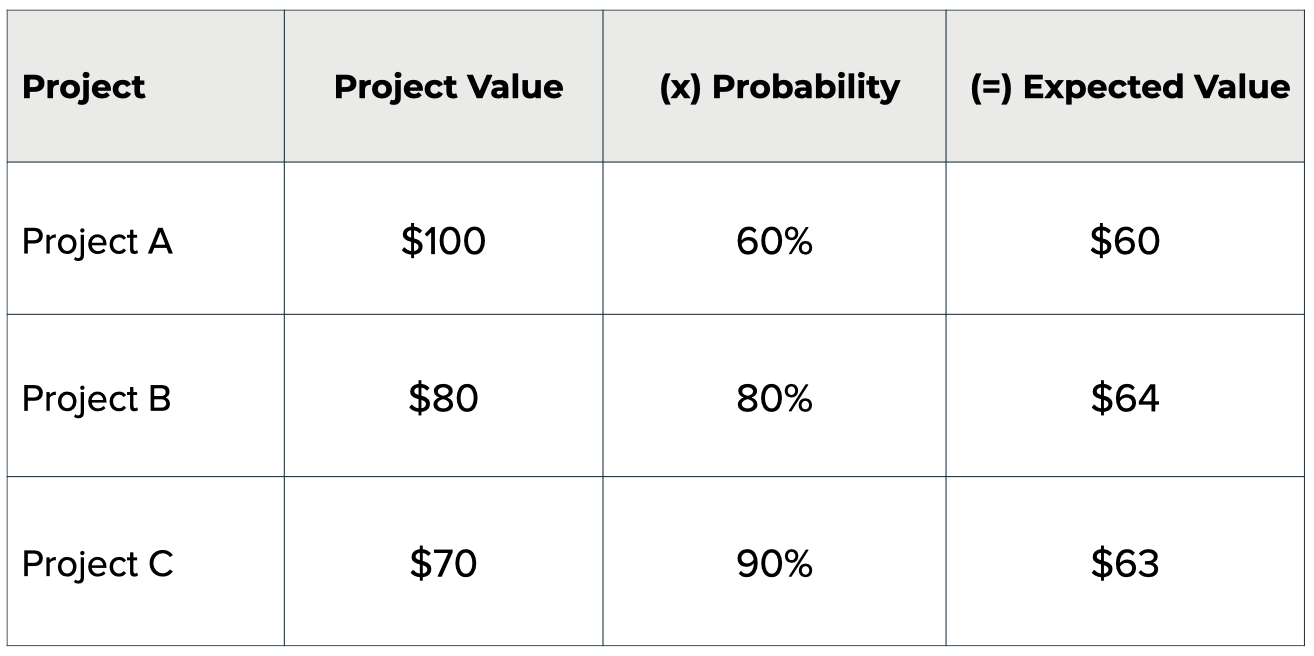

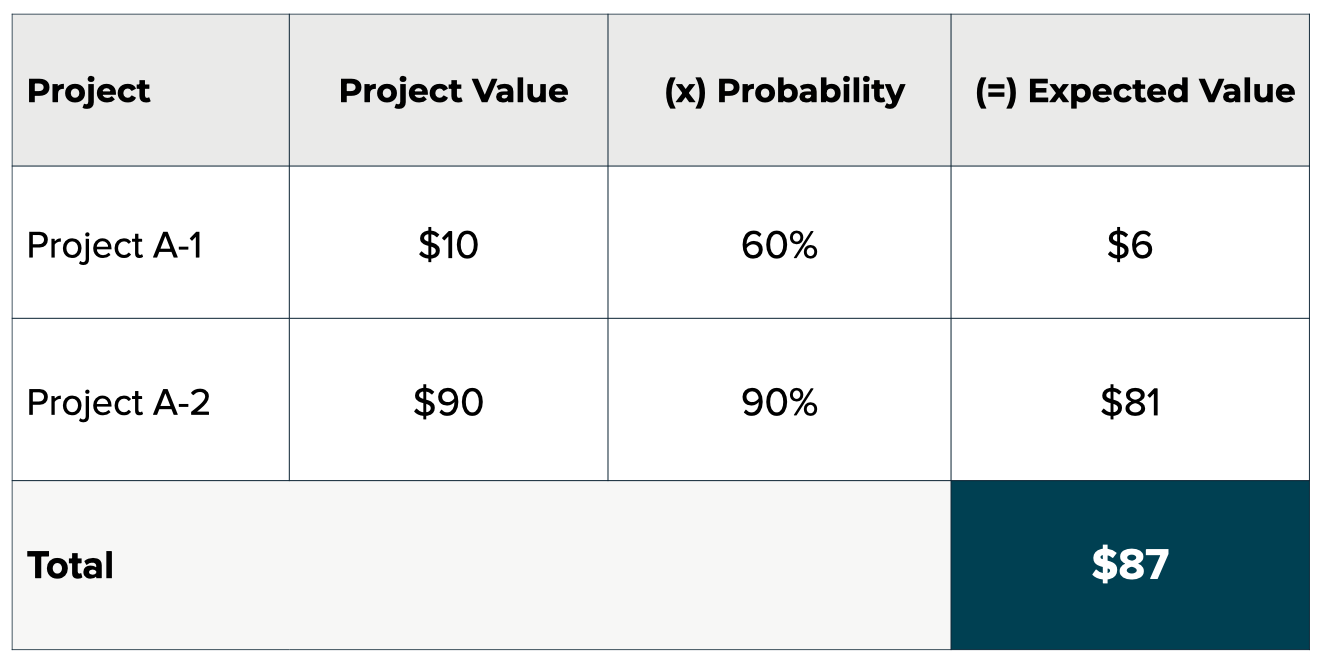

If we put each project into a chart with its Financial Value and probability of success or failure ("risk"), we can find its Expected Value:

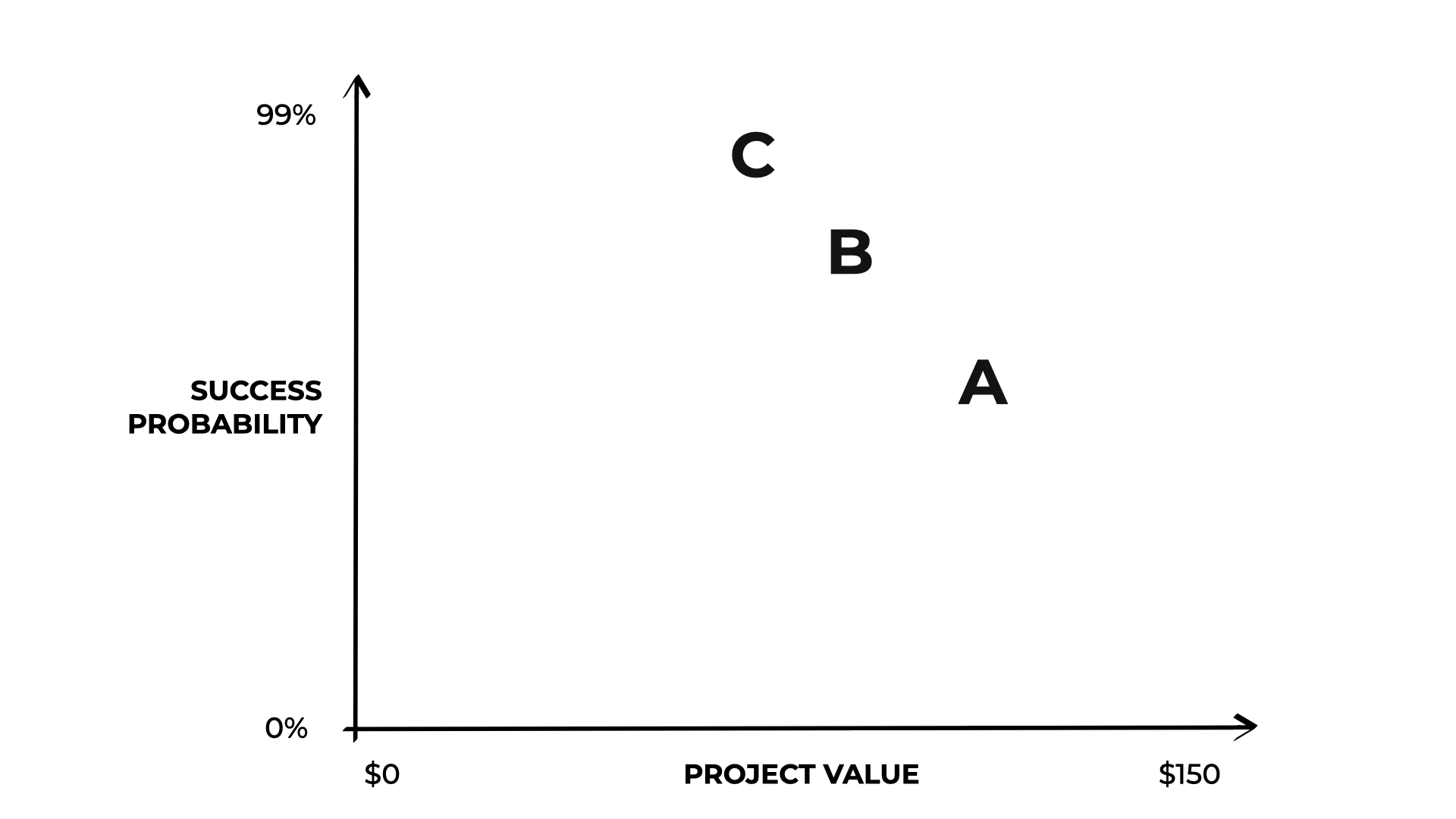

Interesting right? Now let's use a different view. We'll plot each project on a graph with two axes, Project Value (X) and Success Probability (Y). You can see how they shake out here:

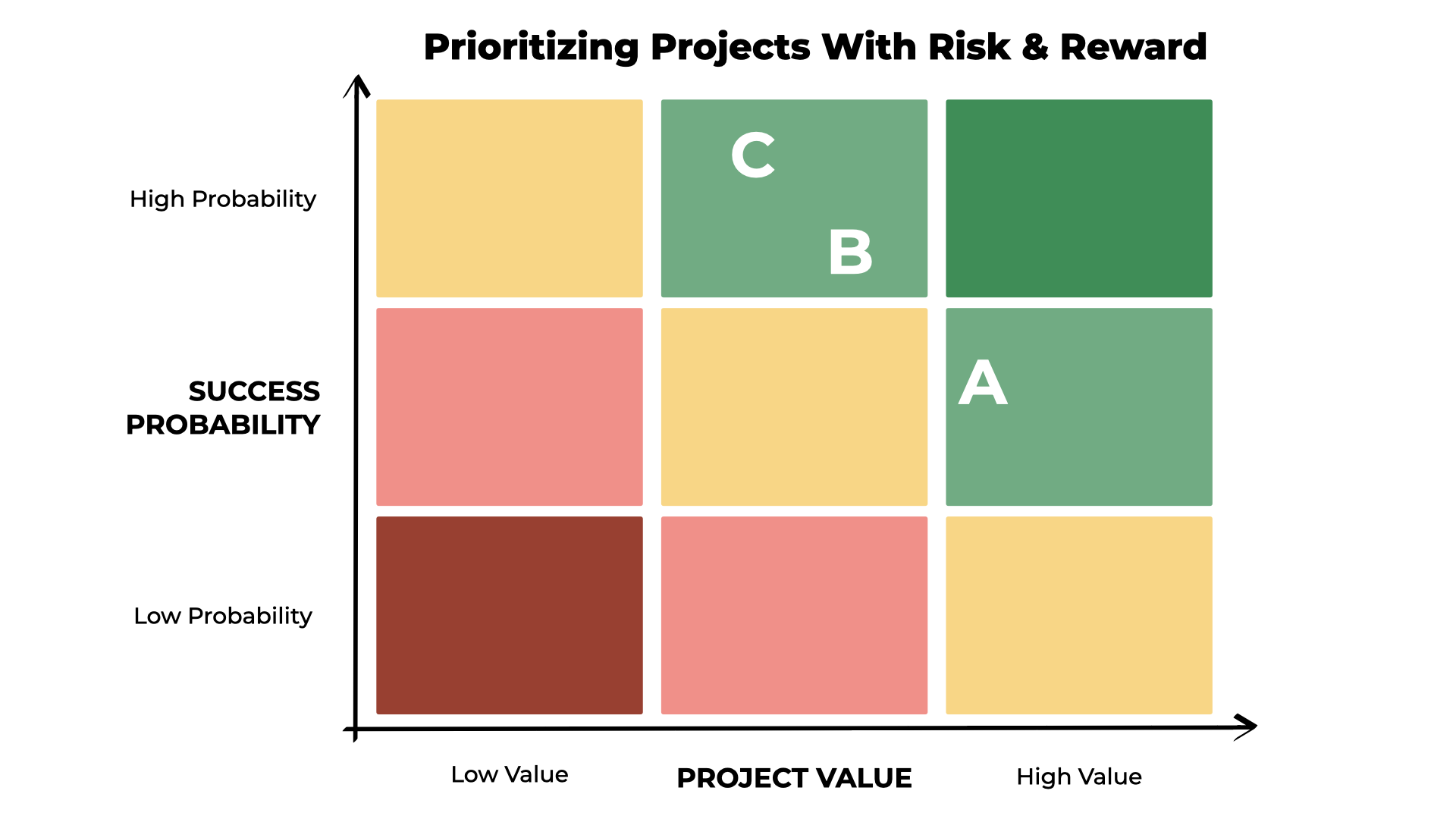

Now, let’s overlay this matrix on top of this color-coded, 3x3 grid:

What's interesting is all three projects fall in a similar color (light green), with a fairly similar Expected Value (~$60).

Which is where risk appetite comes into play. Generally speaking, if the Expected Value is the same, CFO’s will always prefer the project with less risk.

So if you look like “Project A” in these scenarios, the fastest way to become more appealing is to de-risk the project. Take risk off the table with your deal structure, for example:

- Starting with a small pilot to prove out one key risk.

- Scaling up to the full project based on success,

After, you’ll have jumped ahead of Projects B and C. This looks like:

Putting you here in the CFO’s mind:

By the way, risk is another way you can create new deals for yourself.

If you’re lowering the risk profile of an existing investment, that’s a value add. Because CFO’s can do one of the following things to mitigate risk:

- Avoid It. Remove its cause altogether.

- Reduce it. Buying / building / partnering to act differently.

- Transfer It. Take out an insurance or shared-risk policy.

- Plan For It. Create options and contingencies.

If you can provide the first option, then, obviously, you’re in a great position.

Even during a spending freeze because you’re immediately raising the Expected Value of every project they’ve already invested capital into.

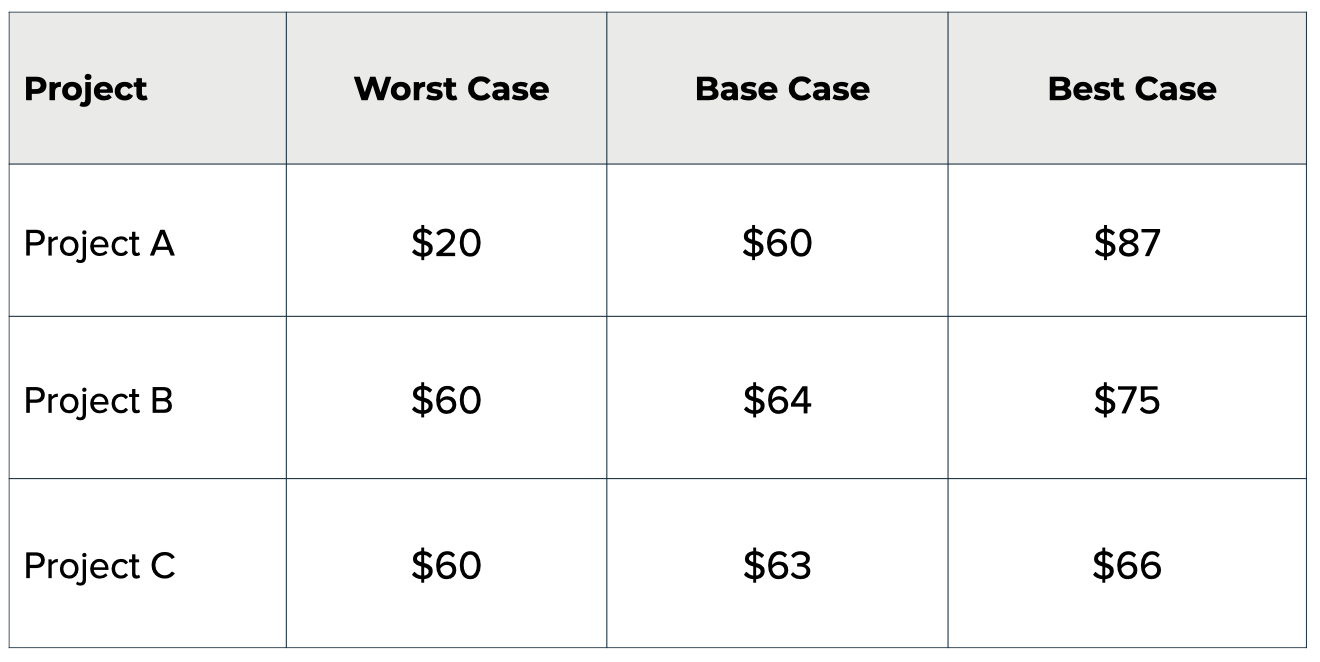

Last, there’s one more element to risk we need to cover. Risk is never a “known known.” So figuring out just how much “variance” exists between the best, worst, and most likely scenarios (aka the ”base case”) is an exercise finance teams are pro’s in.

This can dramatically swing how attractive a deal is, and it’s done using a “sensitivity analysis.” Which shows the ripple effect of a change to one assumption on a target outcome.

Project A might be prone to more wild swings, while Project B’s upside is fairly reasonable. This makes Project B more attractive after the sensitivity analysis.

(Assuming no adjustments to the deal structure of Project A, to make A even more competitive.)

By the way, Finance teams will spend as much time as is reasonable to model these scenarios. If there’s a low risk decision, they’ll put less effort into diligence. But a lot of time may go into modeling more risky choices — which gets stretched into months worth of sales cycle time.

This is exactly why the ‘Investment’ section of The 1-Page Business Case ends with scenarios. It’s how CFO’s think. They’re used to having control over a decision, to balance risk and reward, according to their appetite and their full “portfolio” of projects.

Download the framework, then watch a walkthrough of how to use the framework in this Buyer Enablement Crash Course preview.

FAQ's on:

Why stop now?

You’re on a roll. Keep reading related write-up’s:

Draft with one click, go from DIY, to done-with-you AI

Get an executive-ready business case in seconds, built with your buyer's words and our AI.

Meet the sellers simplifying complex deals

Loved by top performers from 500+ companies with over $250M in closed-won revenue, across 19,900 deals managed with Fluint

Now getting more call transcripts into the tool so I can do more of that 1-click goodness.

The buying team literally skipped entire steps in the decision process after seeing our champion lay out the value for them.

Which is what Fluint lets me do: enable my champions, by making it easy for them to sell what matters to them and impacts their role.